42 coupon rate and ytm

Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the same.... Difference Between Yield to Maturity and Coupon Rate ... The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS. 1.

Yield to Maturity (YTM) - Meaning, Formula and Examples The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Let's say the purchase price falls to 1,800. Current Yield = 160/1,800= 0.089 or 8.9%. The current Yield rises if the purchase ...

Coupon rate and ytm

Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Yield to Maturity (YTM): Formula and Excel Calculator An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value. What is the difference between the YTM and the coupon rate ... Answer (1 of 4): The coupon rate is the annual amount of interest a bond pays and it is fixed on the day the bond is issued for $1000. So a 5% coupon, 10-year bond will pay $50 per year for the life of the bond, no matter whether the price of that bond goes up or down between the issue date and ...

Coupon rate and ytm. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Bond Yield to Maturity (YTM) Calculator - DQYDJ We calculated the rate an investor would earn reinvesting every coupon payment at the current rate, then determining the present value of those cash flows. The summation looks like this: Price = Coupon Payment / ( 1 + rate) ^ 1 + Coupon Payment / ( 1 + rate) ^ 2 ... + Final Coupon Payment + Face Value / ( 1 + rate) ^ n Coupon Bond Formula | How to Calculate the Price of Coupon ... Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2 Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Difference Between Coupon Rate and Yield to Maturity (With ... The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve. Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics When a bond is issued, the issuing entity determines its duration, face...

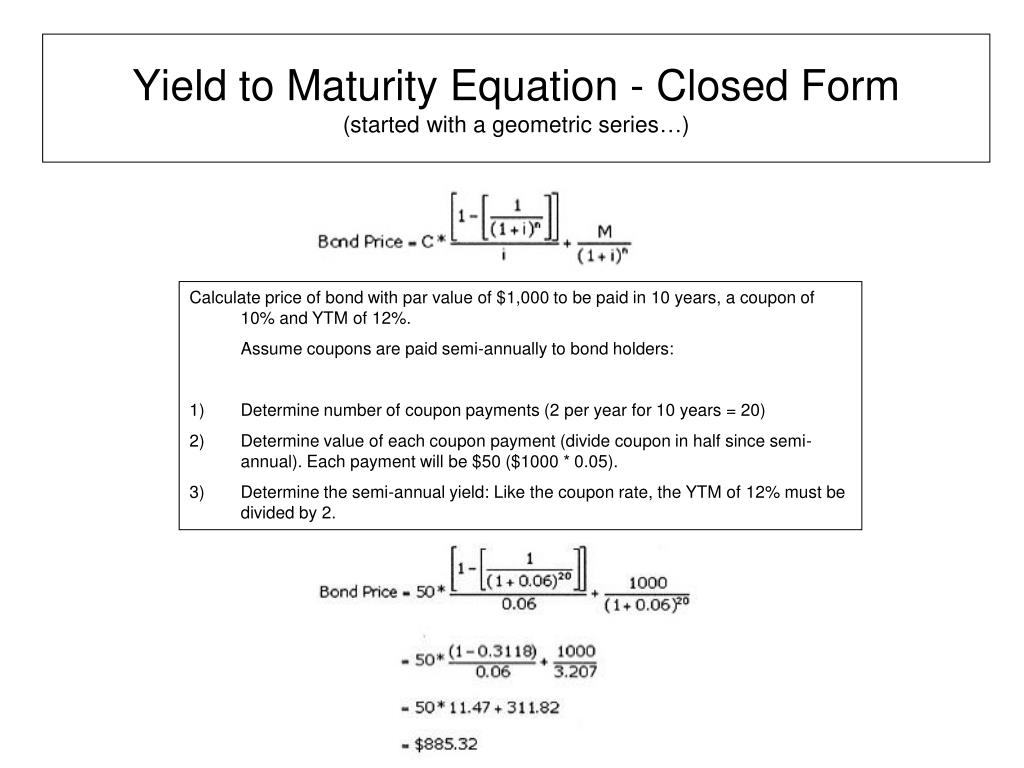

Bond Pricing Formula |How to Calculate Bond Price? Where. n = Period which takes values from 0 to the nth period till the cash flows ending period C n = Coupon payment in the nth period; YTM = interest rate or required yield P = Par Value of the bond Examples of Bond Pricing Formula (With Excel Template) Let's take an example to understand the calculation of Bond Pricing in a better manner. Difference between Coupon Rate And Yield To Maturity 30 Sept 2020 — Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over ...Face value: 10% Relationship Between Coupon and Yield - Assignment Worker YTM with Semiannual Coupons. Suppose a bond with a 10% coupon rate and semiannual coupons, has a face value of $1,000, 20 years to maturity and is selling for $1,197.93. 40 N. 1197.93 PV (negative) 1000 FV. 50 PMT. CPT PV 4% (= ½ YTM) YTM = 4%*2 = 8%. NOTE: Solving a semi-annual payer for YTM. results in a 6-month yield. The calculator & Excel Yield to Maturity Calculator | Calculate YTM coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency.

Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

Par rate, coupon rate and YTM : CFA The par rate is: the COUPON RATE that makes that a bond will sell at par GIVEN interest rates (that is, given by the markt), or the YTM that makes that a bond will sell at par GIVEN coupon rate (that is, the coupon that decides the goverment). I know that it sound stupid and I'm 99,999% sure that the option correct is 1). I need confirmation.

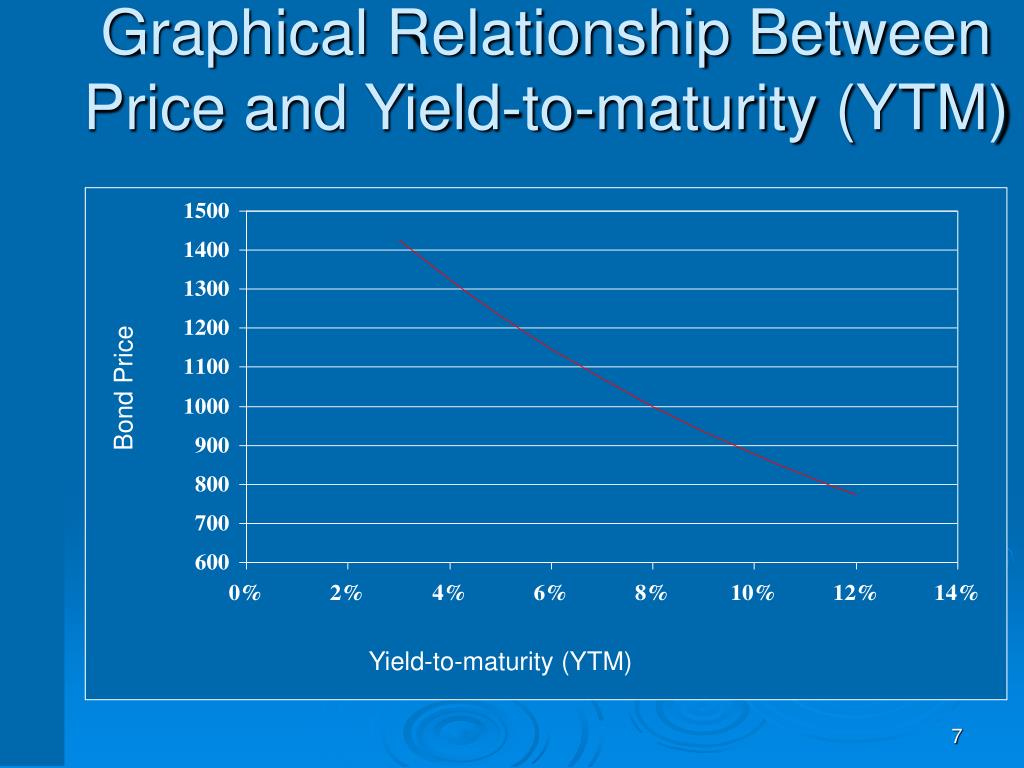

Concept 82: Relationships among a Bond's Price, Coupon ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Understanding Coupon Rate and Yield to Maturity of Bonds ... Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond's cash flows equal to the current market price.

What is the Difference Between YTM and Coupon rates ... Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation.

b P 0 par and YTM the coupon rate c P 0 par and YTM the ... P 0 > par and YTM > the coupon rate. c. P 0 > par and YTM < the coupon rate. d. P 0 < par and YTM < the coupon rate 6. In 3 years you are to receive $5,000. If the interest rate were to suddenly increase, the present value of that future amount to you would a. fall. b. rise. c. remain unchanged. d. cannot be determined without more information

Post a Comment for "42 coupon rate and ytm"