38 find the coupon rate of a bond

How To Find Coupon Rate Of A Bond On Financial Calculator To calculate the coupon rate on a financial calculator, enter the face value of the bond and then press the 'Coupon' or 'CP' button. This will bring up a list of different coupon rates. Find the coupon rate that matches the interest rate on your bond and press enter. The COUP function will then calculate the coupon rate for you. Formula: C=PZ ^ k › eneasyJet | Cheap flights ️ Book low-cost flight tickets 2023 Find Cheap Flights with easyJet Over the last 25 years easyJet has become Europe’s leading short-haul airline, revolutionising European air travel by allowing passengers to book cheap flights across Europe’s top flight routes, connecting more than 30 countries and over 100 cities.

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

Find the coupon rate of a bond

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value. For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate Formula & Calculation - Video & Lesson Transcript Apr 8, 2022 ... Identify the par value of the bond. · Identify the frequency of periodic payments (or coupon payments) that have been made. · Calculate the ...

Find the coupon rate of a bond. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Firstly, determine the par value of the bond issuance, and it is denoted by P. Next, determine the periodic coupon payment based on the coupon rate of the bond based, the frequency of the coupon payment, and the par value of the bond. The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% | Short-term Airbnb & traditional rental analysis Our real estate blogs cover all topics related to residential real estate investing such as locating the best places to invest in real estate, conducting investment property search, performing rental property analysis, finding top-performing investment properties, choosing the optimal rental strategy (traditional or Airbnb), and others. › terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Coupon Bond Formula | Examples with Excel Template - EDUCBA The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. As per the current market trend, the bonds with similar risk profile have yielded to maturity of 6%. Calculate the market price of the bonds based on the given information. Colombia Girds for Bond Coupon Shock to Cut Refinancing Risk Colombia Girds for Coupon Shock in Bond Sale to Extend Maturity. Nation plans to tap global markets for 10-year dollar bond. Yield discussed in mid-8% area as investor demand gauged. Columbia's ... time.com › nextadvisorHome | NextAdvisor with TIME The I Bond Rate Fell Below 7%. We Answer Your Questions 7 min read. 4 Ways the Fed’s Interest Rate Hikes Directly Affect Your Money — and What You Can Do About It 9 min read. Zero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value... Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Find the bond coupon rate. The coupon rate is usually expressed as a percentage (e.g., 8%). [4] You'll need this information, also provided by your broker, to calculate the coupon payment. 4 Get the current yield, if available. The current yield will show you your return on your bond investment, exclusive of capital gains. [5] How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example,...

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less than the face amount of a bond, the current yield ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

› techTech | Fox News News for Hardware, software, networking, and Internet media. Reporting on information technology, technology and business news.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Calculate the Coupon Rate of a Bond - YouTube 0:00 / 2:44 Calculate the Coupon Rate of a Bond 33,837 views Jul 25, 2018 This video explains how to calculate the coupon rate of a bond when you are given all of the other terms...

› lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

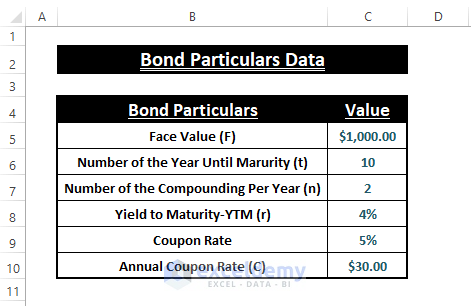

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Answered: Calculate the price of a zero-coupon… | bartleby BOND VALUATION Bond X is noncallable and has 20 years to maturity, an 8% annual coupon, and a 1,000 par value. Your required return on Bond X is 9%; if you buy it, you plan to hold it for 5 years. You (and the market) have exportations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 7.5%.

Formula to calculate the coupon rate of a bond - IndiaInfoline The coupon rate is stated in terms of a bond's annual interest payment as a percentage of its face value. For example, if you buy a bond that has a face value ...

Bond Price Calculator | Formula | Chart Calculate the coupon per period. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50 ...

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Coupon Rate Formula & Calculation - Video & Lesson Transcript Apr 8, 2022 ... Identify the par value of the bond. · Identify the frequency of periodic payments (or coupon payments) that have been made. · Calculate the ...

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value. For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%.

![Solved Problem 6-33 Coupon Rates [LO 2] You find the | Chegg.com](https://d2vlcm61l7u1fs.cloudfront.net/media%2Ff03%2Ff03d6014-74fb-4eaa-925c-f616ab6ad67e%2FphpfU7HCp.png)

![Solved Problem 6-33 Coupon Rates (LO 2] You find the | Chegg.com](https://media.cheggcdn.com/media/f0d/f0d3e3cc-89c9-4eed-b5c1-9f247c01695c/php2LGFUe.png)

Post a Comment for "38 find the coupon rate of a bond"