40 are zero coupon bonds taxable

Tax Considerations for Zero Coupon Bonds - m.finweb.com Municipal zero coupon bonds--Municipal bonds are those that are issued by certain government entities like city governments and school districts. Interest that is earned on municipal bonds is not taxable. Therefore, you can simply buy the zero coupon bond and then collect your interest at the end without worrying about anything in between. Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Tax Considerations for Zero Coupon Bonds - Financial Web Municipal zero coupon bonds--Municipal bonds are those that are issued by certain government entities like city governments and school districts. Interest that is earned on municipal bonds is not taxable. Therefore, you can simply buy the zero coupon bond and then collect your interest at the end without worrying about anything in between.

Are zero coupon bonds taxable

Zero Coupon Bonds: Know tax rules when such a bond is held till ... As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don't get regular interest, but get a deep discount on face value at the time of issuance of such a bond. Are zero coupon bonds taxable? - Financial Memos Zero Coupon Bonds mean that interest is accrued but it will be paid when the bond matures. Tax is paid on the accrued interest regardless of the fact its not paid. Of course, there are some zero coupon bonds that do not attract tax such as the municipal zero coupon bonds. Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price of the bond.

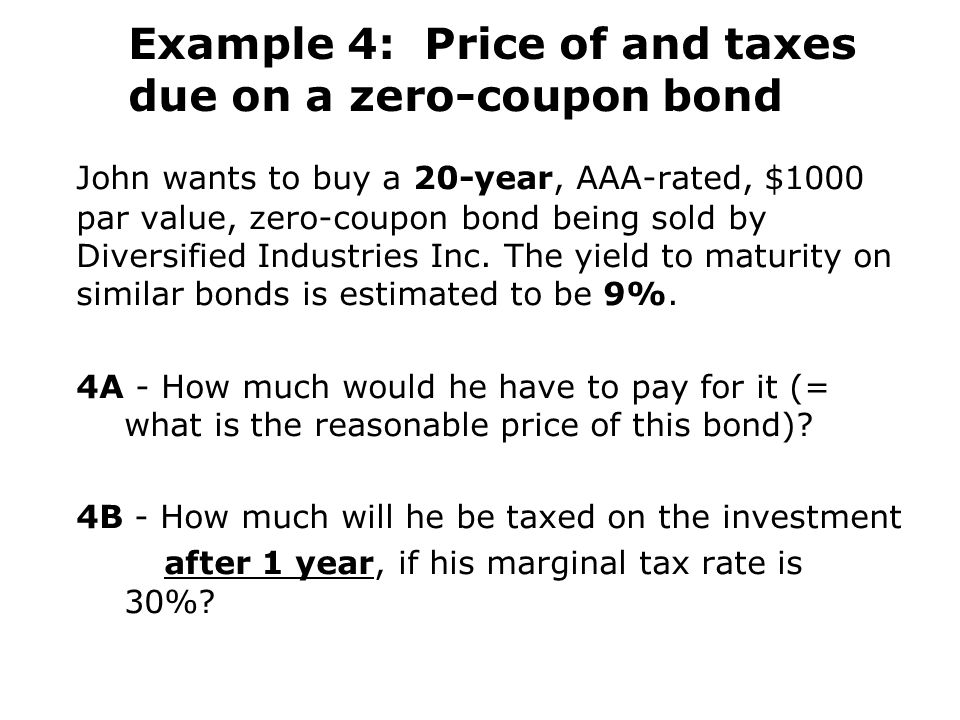

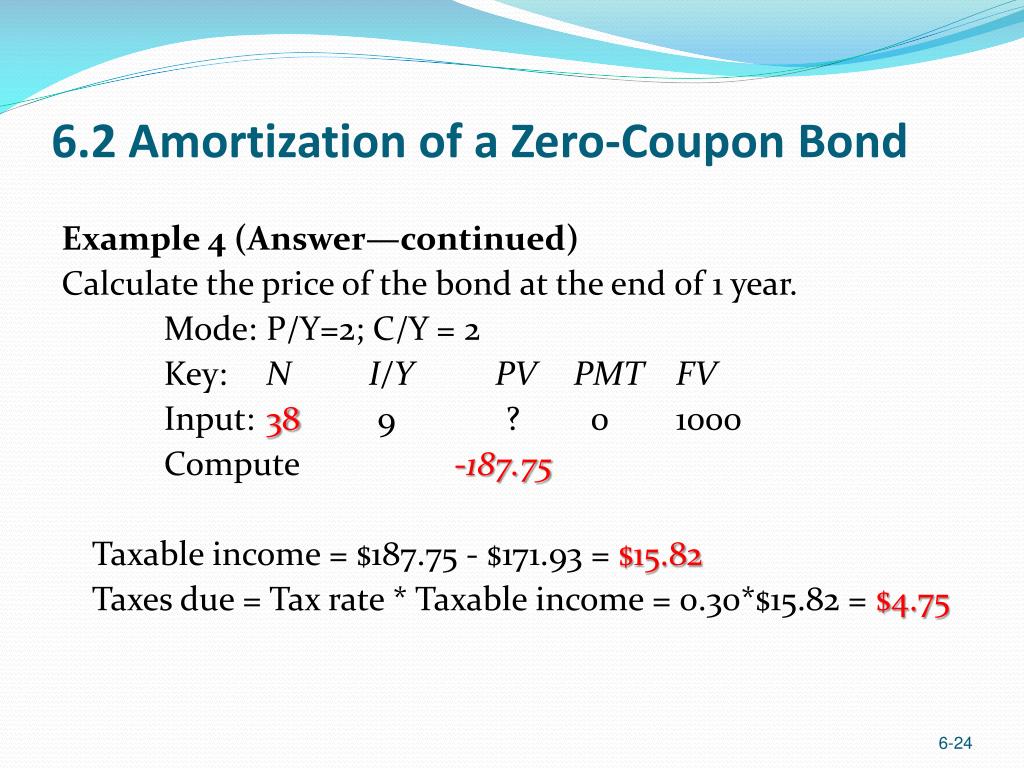

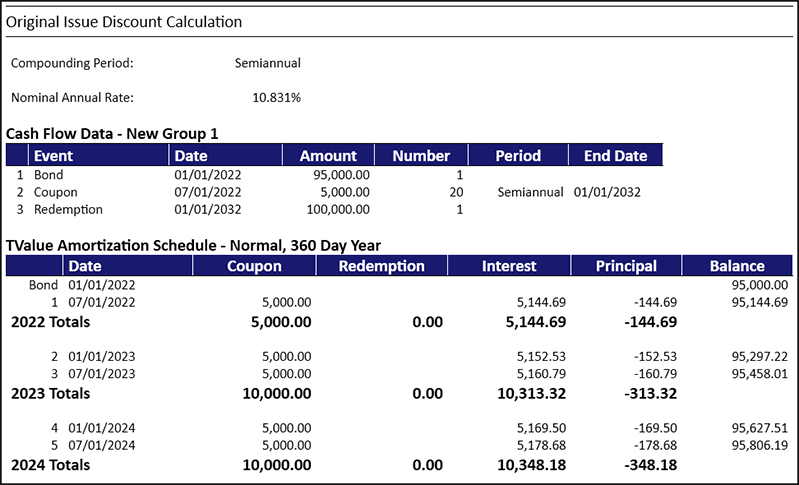

Are zero coupon bonds taxable. PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) payments. First the yield needs to be calculated. We will present a simplified three year zero coupon bond as an example. The taxable zero coupon bond is purchased for P = $900 with a value at maturity M = $1000 in three years. Let y = yield so that (1) 900(1 + y)3 = 1000, y = 1 1000 3 900 ªº «»¬¼ - 1 = .0357442 = 3.57442% . Next the (phantom Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... It discusses the income tax rules for figuring and reporting OID on long-term debt instruments. It also includes a similar discussion for stripped bonds and coupons, such as zero coupon bonds available through the Department of the Treasury's STRIPS program and government-sponsored enterprises such as the Resolution Funding Corporation. How is tax calculated on a zero coupon bond? - Quora So, on a 2-year, zero-coupon bond you bought for $900, the imputed interest for this year would be $50. You will pay tax on the $50, whether you actually made $50 or not. It is often called "phantom" interest, for this reason; and is often the reason people relegate zeros to their IRA, if at all possible. More answers below John Peters Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price of the bond.

Are zero coupon bonds taxable? - Financial Memos Zero Coupon Bonds mean that interest is accrued but it will be paid when the bond matures. Tax is paid on the accrued interest regardless of the fact its not paid. Of course, there are some zero coupon bonds that do not attract tax such as the municipal zero coupon bonds. Zero Coupon Bonds: Know tax rules when such a bond is held till ... As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don't get regular interest, but get a deep discount on face value at the time of issuance of such a bond.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "40 are zero coupon bonds taxable"